Asset protection trusts are designed to protect your funds from creditor claims.

Without an asset protection trust, a creditor with a judgment against you can potentially seize all your assets to satisfy their judgment against you. With the trust, a creditor is limited to only those assets that are outside the trust.

Michigan is now the 17th state to adopt trust laws that can help you shield your assets from creditors. Michigan’s Qualified Dispositions In Trust Act now allows for the creation of these kinds of trusts. The trust will protect your assets from creditors so long as the appropriate steps are taken. When an asset protection trust is created and assets transferred into it in a timely fashion, in a way that meets the requirements of the law, your wealth can be secured.

Whether you’re a doctor, dentist, lawyer, accountant, businessman, or other professional, you can be exposed to lawsuits due to your success. A properly created Domestic Asset Protection Trust can now help secure you from predatory lawsuits and shield your assets from potential future creditors.

The asset protection trust can, for example, also protect assets from the risks that can occur in cases of divorce if created prior to the marriage. The trust can act as a very effective prenuptial agreement. In fact, it can even be stronger than such an agreement.

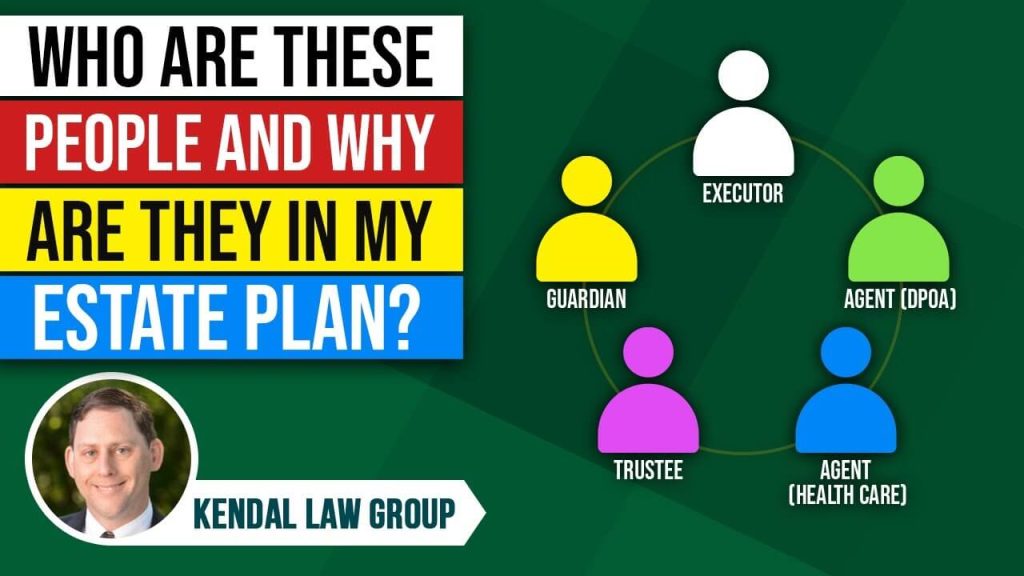

Kendal Law Group can help you create an Asset Protection Trust to secure your fortunes and protect your assets from creditor claims.